|

Featured

Program |

Venture Financing Roundtable

Hosted at Seattle University

|

Testimonial of the Month

"Rob, I downloaded all the papers I could from your web site (almost 2 inches thick).

I have learned more from you than anybody I've talked to in the last 10 years."

- Ernest Baker, CEO

- Healthy Check Inc.

Click for More Testimonials

Program Calendar

Coming this spring!

• Chad Waite, OVP Venture Partners - 4/6/04

• Kevin Cable, Cascadia Capital - 4/20/04

2004 Roundtable Dates!

May 4, 2004

May 18, 2004

2004 Seattle University

Business Plan Competition

Winner gets $10,000

Candidates Attend Venture Financing Roundtable for Expert Coaching & Equity Marketing Education

Live Venture Consulting!

Investors + Entrepreneurs

|

|

|

The Venture Financing Roundtable

April 2004 Calendar

Last Tuesday's program was a great time, with a balanced mix of investors, entrepreneurs, and experts

participating.

Dr. David Andrade presented advanced valuation models using real-time monte-carlo simulation impressed the audience, and help to demonstrate how entrepreneurs

must go beyond static DCF analysis to properly present the risk of their business case.

Coming up in April:

Seattle University Business Plan Competition

Investment Forum /

Venture All Stars Assessment Signups

Coming Tuesday,

April 6, 2004

Register Now - Seats are selling.

Title: Value Building - OVP Style

Featuring:

Chad Waite, OVP Venture Partners

Perry Fell, Ph. D., Co-Founder, Chairman, Seattle Genetics

Guest Host: Warner Wong, former director, WSU SBDC

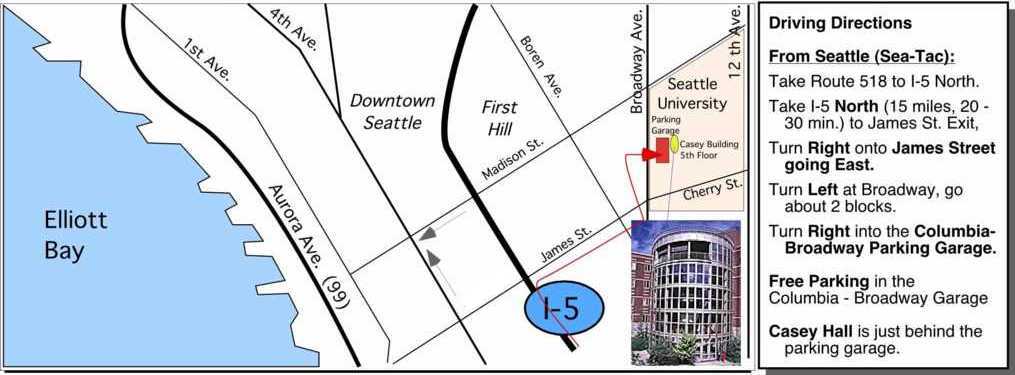

Live Venture Consulting: 5:30 to 7pm "on the

white boards"

Speaker Presentations: 7pm to 9pm

Join us for an eye-opening conversation with leading VC Chad Waite of OVP Venture Partners and entrepreneur Perry Fell, CEO of 5-month old Seattle start-up NanoString, and former CEO and co-founder of Seattle Genetics. Learn about the journey from when OVP first assessed the Seattle Genetics investment opportunity and how the relationship between Chad and Perry developed.

Learn what it took for OVP to generate a return on its invested capital. Explore with both parties, the process of managing expectations in a dynamic environment. Learn how OVP helped the team solve a particularly difficult 'deal killer' dilemma that affected all shareholders in the project. Hear from the CEO how he used the VC´s advice to augment the strategies and tactics in order to balance management and investor goals.

Find out from these pros what it takes to get venture backed and what to expect after the check comes in.

About Chad Waite

Chad Waite is a General Partner with OVP Venture Partners, the leading venture capital firm in the Pacific Northwest, with over $500 million in capital under management. Chad has been in the venture business since 1983, having started in Hambrecht & Quist's Venture Group in San Francisco, before moving to Olympic Venture Partners (now called OVP) in Seattle in 1987.

In more than 20 years in the business, Chad has helped 21 companies achieve successful IPO´s, as well as many others successfully be realized via M&A transactions. He has lived through two complete boom and bust cycles, and so brings a wealth of experience to the table on how the venture industry works, in good times and bad. Chad has successfully invested across the range of technology businesses, from software to communications to health care. Last year, he was voted MVP of the Seattle VC community. Chad is, by far, the most successful venture capitalist in the Pacific Northwest, and has been listed by Forbes as one of the top 100 in the industry overall.

Some of the companies under Chad's watch have included: Watchguard (Nasdaq: WGRD), Verity (Nasdaq: VRTY), Signalsoft (acquired by Openwave (Nasdaq: OPWV), @mobile (also acquired by Openwave), Elekom (M&A to Clarus (Nasdaq: CLRS), 4thPass (acquired by Motorola, Rosetta Inpharmatics (acquired by Merck), and Boston Beer.

OVP originates and leads investments in early-stage communications, software and electronics. With offices in both Portland and Seattle, OVP has invested in some of the top performing startups in the region. OVP brings over 20 years of proprietary deal flow, start-up company operating experience, investing wisdom and top tier returns to the business. OVP closed on its sixth venture fund at $185 million in 2002.

About: H. Perry Fell, Ph.D., M.B.A.

Co-Founder, Chairman of the Board

Seattle Genetics, Inc.

Fell co-founded Seattle Genetics in 1997. He has served as chairman of the board since March 2002, as chief strategy officer since November 2002 and as a director since December 1997. He also served as president from December 1997 to June 2000 and as chief executive officer from December 1997 to November 2002. Prior to co-founding Seattle Genetics, Fell was with the Bristol-Myers Squibb Pharmaceutical Research Institute as a research scientist from June 1986 to April 1989 and as director of the molecular immunology department from April 1989 to December 1997. Fell serves as a director of International Therapeutics, a biotechnology company. Fell received a master's degree in business administration from the University of Washington, a doctorate in immunology from the University of Texas at Dallas and a bachelor's degree in microbiology from the University of Texas at Arlington.

Programs that feature VCs tend to sell out, so

please register in advance.

- Call me if you have questions. - Rob

|

In Partnership with:

|

| |

|

Spring 2004 Calendar:

April 20, 2004 - Kevin Cable, General Partner, Cascadia Capital LLC

Title: Managing Investor Expectations for an Acquisition Exit from Day 1

Sponsored by:

|

|